T he screener.in is a very awesome website, to conduct a fundamental analysis of a company. Using screener.in to conduct a fundamental analysis of the company is very useful for investors like me. In fact, the financial reports presented by the Screener website are easy to adapt and easy to use.

The screener is a wonderful website to do fundamental analysis of the company. I use the Screener.in website to read and understand the financial figures of a company. When you search for a stock in the stock search area, you will find very important information related to that company stock in the search results like company overview, chart analysis, peer comparison, quarterly result, profit and loss , balance sheet etc.

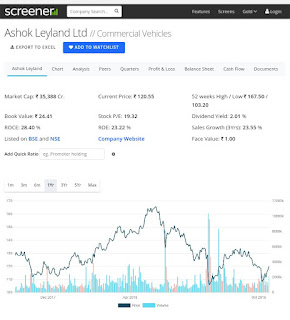

The most important part about the Screener website is that you can read a company's financial statement for the last 10 years in one place. The picture below presents important information about Ashok Leyland Company.

SourceScreener.in

However, the most important tool for this website is not being used by most people. It’s query builder. Most people know how to read company’s financial in the Screener website, but most people do not know how to write query in a Query Builder.

First of all, if you do not know about query then first read its definition.

What is query - A query is a request for data or information from a database table or combination of tables. For example, if you want a specific type of stocks from a table of all the stocks listed, you can write a query to request that information.

The query builder is used in many ways. In this post, we are going to see how the screener website is used efficiently with the Query Builder. You need to create an account to use Query Builder on the Screener website, you can also use your Google or Facebook account to create an account.

How to use query builder ?

In Query Builder, you can search data or information by typing quarry. The quaries are in one line or in multiple lines.

Price to earning < 15

Now, if you want to search for a company whose price to earning ratio is less than 15 and whose price to book ratio is less than 3 then you have to write the following query.

Price to earnings < 15 AND

Price to book value < 3

Finding small cap Mid cap Large cap Companies.

Small cap companies market capitalization < 500cr.

Mid cap companies market capitalization – 500 cr to 10,000 cr.

Large cap companies market capitalization - > 10,000 cr.

With the help of above query, you can get important information about small, medium, and large companies.

For example, if we want a list of companies whose market capitalization is less than 500 crores, then we have to write the following query in the Query Builder.

In the same way you can also write query to find middle and large companies.

Finding penny stock.

A company whose share price is below 10 rupees and whose market capitalization is below 100 cr. is called Penny Stock.

In the Screener Query Builder you can get the list of Penny Stocks by writing the following query.

Current price < 10

Finding debt free companies.

I choose debt-free companies for my long-term investment, or choose companies that have low debt burden. Because, the burden of debt on a company will be as low. The better the development of that company in the future.

We will use the debt equity ratio to know the debt free company.

If a company's debt equity ratio is 0, then it means that the company is debt-free.

If a company's debt equity ratio is 1, then it means that its debt equals equities.

To find a debt-free company, we will write the following query to the Screener Query Builder.

Debt to equity=0

To Find high divided stock.

To get a list of high dividend stocks, we will use dividend yield in Query Builder.

For example, if you want to find a list of companies whose dividend yield is more than 4 percent, then you have to write the following query.

Dividend yield > 4

Create your own screen.

You can use different ratios to create your own stock screen. These different ratios can be ROE, ROCE, PEG, Sales growth, Profit growth, Current ratio, PE ratio, P/BV ratio etc.

Here's an example of a query to screen the stock:

Market capitalization > 500 AND

Sales growth 5 years >15 AND

Profit growth 5 Yeats >15 AND

Debt to equity <1 AND

Net cash flow last year>0 AND

Peg Ratio <1 AND

Promoters holding >30 AND

Pledged percentage <15 AND

Average return on equity shares >12 AND

Generally, I do not use a general query to filter companies for the entire list, but use specific questions for specific industries. Different industries have different specialty ratios.

Similarly, with the help of different ratios, you can create your own stock screens.

Conclusion- Query Builder is a simple and powerful tool that makes your stock research 10 times more simpler. Writing Query is very easy in the query builder, as discussed above in this detail. To make your stock research even more widespread with practising by writing queries.

That's all, in this post, we learned how well we can use the Screener website. I hope this post will be beneficial for you. In the multidimensional way, I use the Screener website, In the best way I have tried to explain it to you. If you facing any problem using the Screener website, you can tell me via the comment box. I will be happy to help you.

I never know about this feature before reading this post

ReplyDeleteThanks for this useful information